VOLATILITY – A FEE, NOT A FINE

Volatility-fatigue has definitely reached a very palpable fever-pitch. I am hearing investors (clients and non-clients, alike) more frequently ask some version of: “when will this craziness end?,” as often as I have ever heard it in my 3-decade career.

Always maintaining my authenticity, my response is “I don’t know, nobody does.”

The only important thing that I am confident of is that it will end. This is not to say that volatility will end – heaven forbid, because if it did, so would the outsized returns and dividend growth equity investors have enjoyed (for nearly a hundred years as documented by the history of the S & P 500 and for about 200 years in general, as documented by Jeremy Siegel in “Stocks for The Long Run”). This is to say that what the individual investor refers to as “craziness,” the seemingly endless slide in stock prices will cease and reverse.

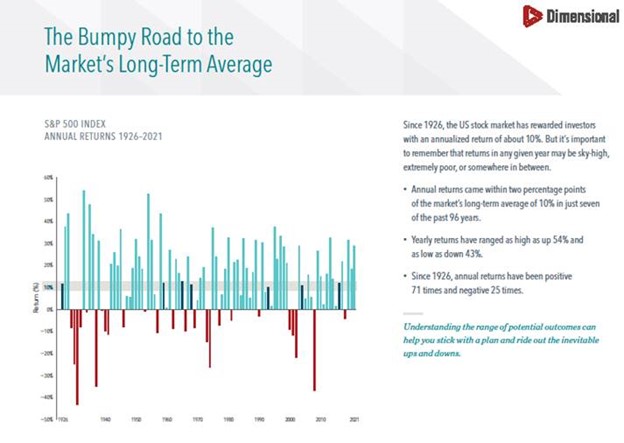

Most investors define “volatility” as sharp and/or sudden market declines. In reality, volatility refers to a random incidence of declines as well as ADVANCES (aka, significant variances) above and below stocks’ relentlessly upward-sloping long-term trend line. And since the variances above the trendline are both greater and longer-lasting than those below it – or else stocks could not have any positive return, much less 10% compounded since 1926. Volatility is not simply benign, but a blessing. It is the engine that drives superior returns. The premium long-term return of equities is simply an efficient market’s way of pricing in their extreme short-term randomness.

DFA fund management’s graphic display : “The Bumpy Road to The Market’s Long-Term Average” offers one of the best visualizations of this truth that I have seen:

While volatility cannot be controlled (without great cost) or predicted, what may be controlled is volatility-fatigue.

Superior market returns are never free and never will be. They demand we pay a price to benefit from them, like we pay to benefit from any other product or service. If we want something, we can either buy it or steal it. Most people know to avoid stealing, as the consequences outweigh the upside. Like everything else worthwhile, successful investing demands a price. But its currency is not dollars and cents. It’s volatility, fear, doubt, uncertainty, and regret – all of which are easy to forget about until forced to deal with them in real time. The inability to recognize that investing has a price, tempts many investors to attempt to get something for nothing, which like shoplifting, rarely ends well. In my three decades of experience, I have found that a majority of investors – although well-meaning and law-abiding -- try to steal successful investment results and often believe they can get away with it. They engage in strategies they hope will help them avoid paying the price for superior returns. They try to exit before the next recession, reenter before the next expansion and engage in all sorts of “hedging,” “alternative” investments, etc.… almost always zigging when they should zag and continually REACTING to current events, the media, and economic and market forecasts rather than continuously ACTING ON A PLAN.

Investors can choose an asset with less uncertainty and a far lower historical payoff, or they can attempt the equivalent of shoplifting – attempting to get equity returns, while avoiding the volatility that comes with them. Some thieves will get away with stealing, while most will pay a dear price. The same fate awaits those investors who try to steal equity returns. Many studies show that those who try it often get ½ or less of the long-term returns that were available to those willing to pay the fee. In my experience, the only way to capture the fullness of equity returns is to be willing/able to capture the fullness of the volatility associated with them.

Why do so many people who are willing to pay the price of cars, vacations, houses, dining, etc.. have such a hard time accepting / paying the price for good investment returns? It is because unlike those tangible goods, the price of investing is not an obvious, measurable number found on a price tag you can see. So, when the bill comes, it doesn’t feel like a fee for getting something good, but like a fine for doing something wrong. While we are generally OK with paying fees, fines are to be avoided. The natural response for anyone who watches their wealth decline (even temporarily) and views that drop as a fine, is to avoid future fines.

In 1960, the first year of the decade I was born, the S & P 500 was 58. It paid $2 in dividends. Today (after being down 25% this year) it stands at 3,700, UP OVER 425 FOLD (including dividends)! Today it pays dividends of $64. So, if my grandfather invested $10,000 for me in 1960, today, with dividends, I would have $4,250,000 and dividend income of about $70,000. The cash-flow is worth 7X the initial investment. Without dividend reinvestment, the $10,000 would be worth $700,000 and dividends would equal $10,000 (the initial investment value). 1

The wonderful miracle of long-term growth in both the prices and dividends will not continue “in spite of the recent market volatility’” but rather, in a very real sense, because of it. VOLATILITY IS A FEE FOR A WONDERFUL BENEFIT, NOT A FINE FOR A BAD DECSION.

Wishing all who celebrate a happy and healthy and sweet New Year and a wonderful Fall season to all!

P.S.

***IMPORTANT REMINDER ABOUT THE COMMONALITY OF SIGNIFICANT MARKET DECLINES AND THEIR RELATIVE INSIGNIFICANCE TO THE LONG-TERM. GOAL-FOCUSED, PLANNING-DRIVEN INVESTOR***

THE STOCK MARKET (i.e., S & P 500) IS SUBJECT TO FREQUENT, OFTEN SIGNIFICANT DECLINES

Since 1980, the average annual decline has been 14%

• During this period, an average decline of 30% occurred about 1 year in 5

Twice since 1980 (in 2000-02 & 2007-09), the S & P 500 has about halved in value! We also observe, most critically, that during this same period, the S & P 500 came into 1980 at about 108, went out of 2021 at 4,766 and produced an average annual compound return in excess of 12%. How can investors begin to hold these two contradictory realities in their heads at the same time?

What renders both statements true is the healing power of time. Since 1926, there have been more than 1,100 rolling 12-month periods (i.e., from Jan. ’26 - Dec. ‘26, then from Feb. ’26 – Jan. ’27, and so on…). This is a much more statistically meaningful period than simply looking at the close to 100 annual periods from ’26 – today). We observe the following regarding the percentage of the rolling periods that produced positive returns:

1-Year rolling periods – 75+%

3-year rolling periods – 84+%

5-year rolling periods - 88+%

10-year rolling periods – 94.5%

The returns for the rolling 15 and 20-year periods were positive nearly 100% of the time!

INVESTORS HOLDING BACK ON INVESTING CASH THAT IS AVAILABLE FOR INVESTMENT is one of the most insidious forms of market-timing. THE ODDS ARE 3-TO-1 AGAINST THAT BEING A SUCCESSFUL STRATEGY IN ONE YEAR. IN 5 YEARS, THE ODDS OF ARE 7-1 AGAINST YOU!

Investors with less than 3-5 year time horizons should not be investing in equities to begin with. INVESTORS WITH TIME HORIZONS EXTENDING 5-10 YEARS, WHO CANNOT TOLERATE EVEN THIS MINISCULE LEVEL OF AMBIGUITY -- THE CHANCE THAT 1 OF 8 OR 9 PERIODS MIGHT NOT YIELD A POSITIVE RETURN -- CAN LIKELY NEVER BE SUCCESFUL EQUITY INVESTORS.

1 Data from: https://politicalcalculations.blogspot.com/ : The S&P 500 at your Fingertips