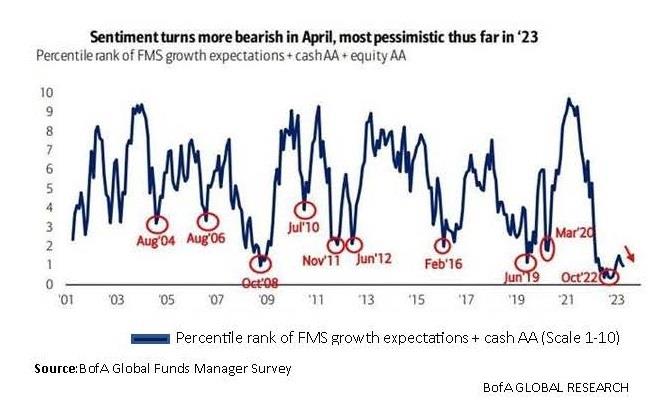

Not only is individual Investor sentiment near historic lows according to the American Association of Individual Investors (AAII), but the sentiment of professional fund managers is lower than at any time in recent history, including the October 2008 trough of the financial crisis. The second lowest sentiment was in June 2019, with fears stoked by US/Chinese trade wars.

The S & P 500 stood at about 1,000 in October 2008. In the 14.5 years since, $1 million has grown to about $4 million. In June 2019, the market was at 2,900. Less than 4 years later, $1 million has grown to about $1.5 million. Annualized returns were 12.5% and 10.5% (with dividends), respectively. Future returns have historically been among the best when sentiment is anywhere near these levels. When things feel great, stocks are usually very expensive (i.e., 1999) with lower expected returns from those levels.

THE CURRENT MOUNTAIN OF WORRIES/FEARS

- The most anticipated RECESSION in modern history.

Whether or not we are currently in or imminently approaching the 11th recession since 1960 should be irrelevant to investors. We can’t know when they will begin or end. What we do know, according to Forbes, is that we have had 13 recessions since 1945 (about 1 every 6 years) and THE S & P 500 HAS RISEN AN AVERAGE OF 1% during all those recession periods. In over half of the 13 years with recessions, the market has posted POSITIVE returns.

- Potential US Government debt default.

There is no question as to our government’s willingness and ability to pay its debts. This is, as it was in 2012, an issue of politics.

- Potential for dollar to lose its status as reserve currency.

The dollar’s share of global currency reserves is 59% today -- it was at a low of 45% in the 1960s. By comparison, the Euro’s share is 20%, while Japan’s is 6%. Moreover, 42% of global transactions are conducted in dollars, 35% in Euros, 6.3% in Japanese Yen and Only 2% are in Chinese renminbi. The UK’s pound sterling was the global reserve currency until the dollar took over in 1944. Today the UK is the world’s 5th largest economy, and the pound only represents 4.5% of global reserves. There are many thriving UK companies and life in Britain seems to be just fine. I can hold in my head the idea that a default is, as anything is, possible and that the dollar could be in danger of losing its status as a reserve currency. I cannot hold these two thoughts in my head together along with the idea that the whole world is still willing to loan us money for 30 years at under 4%.

- Commercial real estate collapse and resulting banking crisis.

THE ROAD AHEAD

The current bear market began in June 2022. The S & P 500’s closing low during this bear market was at 3,577 on October 12, 2022. As I write, the index stands at 4,154 which is just 3% away from entering a new official bull market (at S & P 500 - 4,292) defined as 20% above the closing low. Further the Dow Jones Industrial Average stands 8% from ALL TIME RECORD HIGHS.

According to First Trust, the average bear market since 1942 has lasted 11.5 months and produced an average loss of 31%. This bear market began on June 13, 2022, so based on history, it is not unlikely that its end is near. Importantly, the average bull market since 1942 has lasted 4.4 years and returned 156%. In the past 20 years, according to Hartford Group, 42% of the market’s strongest days occurred during bear markets with another 34% taking place in the first 2 months of a bull market. Most investors I have ever known who tried to time the markets based on current events or short-term economic forecasts have caused serious financial harm to themselves.

Here are some of the catalysts for the likely strong growth ahead:

- The Fed forecasts that interest rates will be close to 3% in 2025 (great for asset prices);

- Companies from Facebook to FedEx to McDonalds are implementing deep cost cuts (will likely lead to dramatic earnings increase);

- US Companies have recently committed to spending $200 billion on new manufacturing projects. One example is Micron Technology’s announcement that it will spend $20 billion to build the largest ever US semiconductor factory and $100 billion over 20 years.

- Artificial Intelligence (AI) is expected to increase productivity analogous to the way the industrial revolution and automation did. Like all new technologies, this will come with challenges, but, wow, is the economic future bright!

This will all likely contribute mightily to record GDP and job growth ahead. According to ARK Invest, it is estimated that knowledge workers -- lawyers, engineers, or computer programmers – who are collectively paid about $32 trillion per year in salaries could be producing $200 trillion per year in economic output with the help of AI by 2030.

Due to the difficulty of forecasting short-term events, we can’t know the direction, up or down, of the next 20% move in stocks. But for the multi-decade (even multi-generational) investor, as all who are reading this are, the only important thing to know is that UP has historically been the only direction of the market’s 100% moves. I view the risk of missing any part of the next 100% permanent move up far greater than the risk of catching the next 20% TEMPORARY move down.

"You never bet on the end of the world, that only happens once, and the odds of something that happens once in an eternity are pretty long."

--Art Cashin

Optimism is the only realism supporting the entire historical record of human advancement.

--Nick Murray