2020-2022

THE MOTHER OF ALL TEACHABLE MOMENTS

In the beginning of 2020, we found ourselves in the throes of a global public health crisis on a scale not seen for about 100 years. In response, the world economy was shutdown. Next, we experienced the fastest, deepest bear market in the S & P 500 of all time -- down 34% in 33 days. Then came the most bitterly hyper-partisan election in recent memory, if not in history, and it didn’t end on election day. We segue from there into a sudden 40-year spike in inflation at a level most investors alive today have no memory of. Next, we became petrified about the extreme rate hikes the Fed might pursue to kill inflation. We also had a war in Europe, instigated by a major nuclear power, followed by a second bear market -- and on and on. What do we know about all these things? We know that they couldn’t have been predicted and that the markets couldn’t have been timed. Who told us that the market could go down 34% in a month for any reason? Having failed to tell us that, who on earth would have suggested that the market would come all the way back in six months, less one day and then go on to make wild new highs in 2021, even as the pandemic continued to roll around the globe in all its various iterations? And then suddenly, who would have said that on New Year’s Eve 2021, Cinderella’s coach would turn into a pumpkin and the footmen turn to mice and the market would experience its worst six-month decline to begin a year (-24%) in 50 years?

The purpose of summarizing this recent nightmare period is to prove to everyone’s complete satisfaction that no one on earth, especially when it mattered most, could have given you the slightest inkling of what the economy was going to do, nor the slightest inkling of what the equity market was going to do. Reflecting on all of that, a reasonable person would conclude that what you were supposed to do was just ride it out. Remarkably, as it always has, that turns out to be right AND THIS IS THE GREAT MESSAGE!

THE ECONOMY CANNOT BE FORECAST & THE MARKET CANNOT BE TIMED.

"IT'S TOUGH TO MAKE PREDICTIONS, ESPECIALLY ABOUT THE FUTURE."

-YOGI BERRA

THE ELUSIVE QUEST FOR CERTAINTY

During times of palpable political, geopolitical, economic, and financial market instability, the media discusses how much investors dislike uncertainty. Large brokerage firms like Merrill Lynch, Goldman Sachs, etc. advise investors to vacillate between what they call a “risk-on” and risk-off” approach to dealing with the perceived uncertainty. They generally define risk-off strategies as those that reduce/eliminate an investors exposure to owning companies (stockholders) and going into cash/bonds.

They improperly define “risk-on” as increasing exposure to stocks and reducing cash/bonds. Since any attempts at market-timing have generally led to reducing often-dramatically long-term returns, advice to sell stocks and to go to cash/bonds in reaction to current events – or any other advice encouraging market-timing -- is a “risk-on” strategy! It is among the biggest risk factors that impede financial goal attainment.

We are planners, not forecasters. While it is never our job to forecast what will happen, it is our solemn responsibility to remind our investors of what has always happened. Rather than create the illusion of certainty for clients, we counsel rationality under uncertainty.

I believe that certainty (defined here as absolutely knowing whether an event/problem will occur, its immediate and long-term effect/resolution, and the timing of both) is a condition that doesn’t simply fail to exist as it relates to the world of investing, but anywhere as a condition in nature. I cannot be certain the sun will come up tomorrow, or that if it does, I or any number of those reading this newsletter will be here to see it. To me, in the absence of absolute certainty, we cannot measure changes in levels of it on a regular basis.

Yet, the news media opines every day on the level of uncertainty and then interviews nameless, faceless industry “experts” with big titles, from respected firms, regarding the ‘appropriate investor response’ to the made-up level of uncertainty. In other words, given that we don’t know how high inflation will go, whether/when we will enter a recession, whether the next Fed rate hike will be ½% or ¾%, etc.… they ask: what portfolio decisions are you recommending to your clients?

If the answer is anything but “my clients have no portfolio decisions to make, they made them all already,” then the “advisor” is not actively involved in attempting to cure the “human nature-as-failed-investor disease,” but, rather, they are carriers of it, helping to spread it!

What does the determination of whether we are currently in recession, the level of the next rate hike, or any sort of current event/market condition have to do with the success of our multi-decade plan? NOTHING WHATEVER IS THE ANSWER!!!

TESTING THIS CONCLUSION WITH A LOOK BACK AT THE PAST 50 YEARS

In terms of the economic and political and geopolitical environment, the past 53 years was fraught with countless challenges, unprecedented uncertainties, and frightening outcomes. Since 1970, the US economy experienced 8 recessions and the S & P 500 has brought us 8 bear markets.

- 1971 - Nixon took us off the gold standard and nearly collapsed the monetary system.

- 1973 - US backs Israel in Yom Kippur War – Arab Oil Embargo, in response, leads to tripling in oil prices and general inflation.

- 1974 - Nixon/Watergate – First constitutional crisis since civil war.

- 1980 - Interest rates, inflation, and unemployment all approach 20%. In contrast, today’s levels of inflation and interest rates are less than ½ what they were then, and unemployment is near historic lows!

- 1987 - On October 19, the S & P 500 fell about 23% -- a record decline that still holds.

- 1998 - Long Term Capital Management, arguably one of the most sought-after hedge-funds of its time -- run by two Economic Nobel Prize winners, needed a $3.6 billion bank bailout led by the Federal Reserve Bank of NY.

- 2001 - we experienced the first-ever terror attacks on a mass scale on US soil.

- 2008-2009 - The housing bubble and related sub-prime mortgage implosion led to the most severe recession since the Great Depression. One of the oldest investment banks that survived for 158 years (including the depression), Lehman Bros., failed.

- 2020-2022 – Pandemic, shuttering of global economy, war instigated by a nuclear power, record monthly market decline, 2 bear markets, deepest/shortest recession in history (March-April 2020).

In addition to all these events (and often in response to them), the S & P 500 declined at least 50% during this period on three occasions (1973-1974, 2000-2002 & 2008-2009).

The other thing that happened is that the S & P 500 came into 1970 at about 90, and as I type this, it stands at just about 4,000. The dividend payout was $3.2. The dividend yield was 3.5% ($3.2 in payments divided by the 90 S & P 500 level). Today the dividend payout is $66, an increase in dividend income of 22X.

Had one invested $1 million at the beginning of this seemingly horrific period, they would have been receiving $35,000 in dividend income in 1970. Inflation, having gone up 8X since then, would mean one needs $280,000 to buy the same goods today.

The current level of our dividend income -- having grown 22X, or almost 3 times the cost of living -- is $770,000. The S & P 500, having gone up 40X has helped us create a legacy for our family of $40 million (to leave a legacy equal to the $1 million in 1970, we would need only $8 million today).

Stocks did nothing remotely like keep up with inflation. They beat the living daylights out of it!

This is what happens to long-term, goal-focused investors who are predominantly invested in stocks. It rarely, if ever, happens to investors who are market-focused, performance- and current events-driven, and who market-time! I view common stock investing and its multi-generational gifts as a miracle, but the average investor still fears and often avoids it. Given current life expectancies, for most investors, the greatest risk involving stocks is, without doubt, that most people do not own enough of them!

WHAT IS IN MY SPHERE OF COMPETENCY AND WHAT IS NOT

Investors are captive to an industry that offers as a value proposition the very poison that kills investors. Conventional-wisdom-based advice emphasizes the importance of variables that cannot be controlled and that are irrelevant (and counter-productive) to a plan’s success. I generally describe this as the timing and selection “value” proposition. Some examples are:

- The ability to outperform a random index (i.e., S & P 500).

- Forecasting the economy.

- The ability to successfully gain a timing advantage over the market by anticipating declines, exiting in advance of them and reentering before the resumption of growth.

- The ability to forecast which sectors and industries will perform best over the short-term.

- Forecasting which growth fund, among all growth funds, will perform better than the others based on past performance or some other variables.

Fusion counsels that we are unable to accomplish any of the above. We are not ashamed of this, since in my 35-year career, I have yet to meet anyone else who can consistently do these things either and they are irrelevant.

"After 50 years in this business, I do not know of anyone who has done market-timing successfully and consistently, I don’t even know of anybody who knows anybody who has done it."

JoHN BOGLE

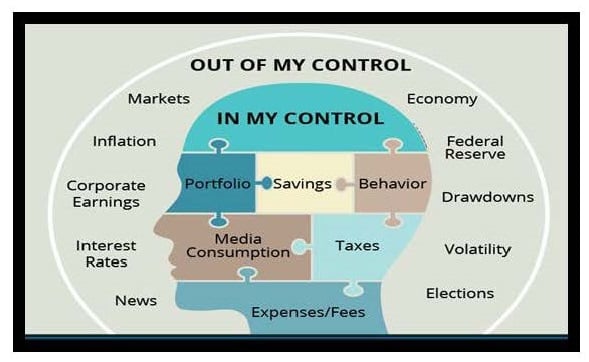

A competent and effective advisor must concentrate all their efforts on guiding clients based on the variables inside the head on the diagram below (those we can control) and none of their efforts on the variables outside (those we can’t control). Unfortunately, a majority in our industry focus mostly on what is outside and almost not at all on what we consider to be the dominant determinant of investment success – behavior. Investors who pay any fee for anything other than a plan and behavior counseling are likely paying for failure.

We firmly believe that we remain in the third and likely longest secular (roughly two-decade-long) bull market in history. They only end on FOMO, when investors are on a major, greed-based, euphoria-driven buying frenzy and the entire culture is consumed with not missing out on the market’s relentless upward movement (they party like it’s 1999). While investors are afraid of everything except missing out (FOMO) --as they are today-- there is very likely little to fear.

Remember what Harry Truman said – “the only thing new in the world is the history you don’t know.”

Our best days are likely ahead, but we must not wait for them to realize how very fortunate we already are today.

Warmest wishes from all of us at Fusion to you and your families for a joyous Holiday and a happy, healthy & prosperous New Year!

WAIT……THERE’S MORE!!!!

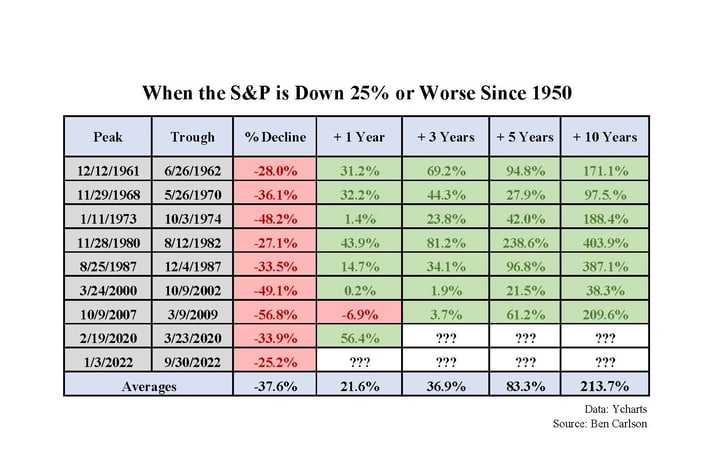

On October 12, 2022, the S & P 500 closed at 3,577, it’s low point for 2022. That was a decline of 25% from its previous peak. As the chart below illustrates, since 1950, a decline of at least 25% has occurred 8 other times. The average returns from the time the market bottomed were 21.6% in one year, 36.9% in three years, 83.3% in five years and 213.7% in ten years.

AND, NO…. THIS TIME IS NOT DIFFERENT!